How and Why Having Multiple Bank Accounts Can Be Useful

Managing personal finances effectively often requires strategic planning, and one such strategy is maintaining multiple bank accounts. While some people prefer simplicity with a single account, having multiple accounts can offer a range of benefits, from improved budgeting to enhanced financial security. If you’re exploring options for a bank near Allentown, understanding how and why having multiple accounts can be useful will help you make more informed decisions about your banking needs.

The Benefits of Having Multiple Bank Accounts

Maintaining multiple bank accounts allows you to allocate your funds more effectively and align them with specific financial goals. Here are some of the key advantages:

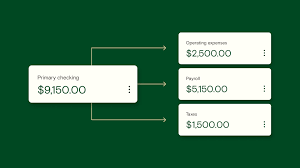

Improved Budgeting and Organization

One of the main benefits of having multiple bank accounts is the ability to segment your finances for better organization. For instance, you can designate one account for essential expenses, another for savings, and a third for discretionary spending. This approach helps you track spending more effectively and prevents overspending in certain categories.

Clear Separation of Goals

By having separate accounts for different financial goals, you can ensure that your savings remain on track. For example:

Emergency Fund: Maintain a dedicated account for unexpected expenses like medical emergencies or home repairs.

Vacation Savings: Set up a separate account to save for trips or leisure activities without impacting your regular budget.

Big Purchases: Use an account specifically for saving toward large purchases, such as a car or home renovation.

If you’re looking for a bank near Allentown, consider one that offers low-maintenance fees and competitive interest rates for multiple savings accounts.

Enhanced Financial Security

Distributing your funds across multiple accounts can provide additional security. In the event of fraud or identity theft, limiting access to a single account can reduce potential losses. Additionally, spreading funds across accounts insured by the FDIC or NCUA ensures your money remains protected up to the insurance limit at each institution.

Easier Expense Tracking

With separate accounts, it’s easier to monitor spending in specific areas. For instance, you can dedicate one account to household bills and another to daily expenses like groceries and entertainment. This method helps you identify spending patterns and make adjustments as needed.

Maximizing Financial Opportunities

Some banks and credit unions offer incentives for opening multiple accounts, such as higher interest rates on savings or waived fees. Researching a bank near Allentown that provides such benefits can help you get more value from your accounts.

Types of Bank Accounts to Consider

Having multiple accounts doesn’t mean opening random accounts without a purpose. Instead, focus on specific types of accounts that serve distinct roles in your financial plan:

Checking Accounts

Checking accounts are designed for everyday transactions, such as paying bills, receiving direct deposits, and making purchases. If you prefer using separate accounts for specific expenses, such as household bills or personal spending, consider opening multiple checking accounts to keep these areas organized.

Savings Accounts

Savings accounts are ideal for accumulating funds for future needs. You can open separate savings accounts for various goals, such as building an emergency fund, saving for a vacation, or preparing for retirement. Look for accounts with competitive interest rates to maximize your savings.

Money Market Accounts

Money market accounts combine the features of checking and savings accounts, offering higher interest rates along with limited check-writing privileges. These accounts are suitable for storing funds you may need occasional access to, such as for a large upcoming expense.

Certificates of Deposit (CDs)

CDs are time-based savings accounts that offer higher interest rates in exchange for locking in your funds for a set period. They’re ideal for goals with a specific timeline, such as saving for a down payment on a home.

How to Effectively Manage Multiple Bank Accounts

While having multiple accounts offers numerous benefits, it’s essential to manage them effectively to avoid confusion or unnecessary fees. Here are some tips to help you stay organized:

Choose the Right Banks

Not all banks are created equal. When choosing a bank near Allentown, look for institutions that offer:

- Low or no monthly maintenance fees

- Competitive interest rates

- Convenient online and mobile banking tools

- Fee-free access to ATMs

- Automate Transfers and Payments

Set up automatic transfers to move money between accounts based on your budget and savings goals. For instance, you can schedule a monthly transfer from your checking account to your savings account for emergency funds.

Keep Track of Account Activity

Use budgeting apps or your bank’s mobile app to monitor account balances and transactions in real time. This helps you avoid overdrafts, track spending, and ensure you’re staying on top of your financial plan.

Minimize Fees

Some banks charge fees for maintaining multiple accounts or require a minimum balance. Choose accounts that fit your budget and waive fees when possible, such as by setting up direct deposit or maintaining a specified balance.

When Does Having Multiple Bank Accounts Make Sense?

While maintaining multiple accounts can be beneficial, it’s not necessary for everyone. Here are some scenarios where it may make sense to open multiple accounts:

Managing Joint Finances

Couples often find it helpful to maintain both individual and joint accounts. Joint accounts can be used for shared expenses like rent or groceries, while individual accounts provide autonomy for personal spending.

Running a Business

If you’re a business owner, separating personal and business finances is essential for accurate bookkeeping and tax preparation. A dedicated business checking account ensures clear boundaries between the two.

Achieving Specific Goals

If you’re saving for multiple goals simultaneously, such as a wedding, a new car, and an emergency fund, having dedicated accounts for each goal makes it easier to track progress and avoid commingling funds.

Avoiding Overspending

Individuals who struggle with overspending may benefit from maintaining separate accounts for discretionary expenses. Once the account for discretionary spending is empty, it serves as a clear indicator to pause non-essential purchases.

Conclusion

Having multiple bank accounts can be a powerful tool for managing your finances, improving organization, and achieving your financial goals. Whether you’re building an emergency fund, saving for a vacation, or separating personal and business finances, maintaining separate accounts offers clarity and control. If you’re searching for a bank near Allentown, prioritize institutions that offer flexible account options, low fees, and robust digital tools to make managing multiple accounts easier. By taking a strategic approach, you can maximize the benefits of multiple accounts and set yourself up for financial success.